The absolute easiest way to acquire your crypto is through a Centralized Exchange (abbreviated by CEX). Think of this as the Coinbase, Gemini, and Binances of the world. You go through their account set up where they need to verify your identity, similar to creating a Robinhood, ETrade account, or other investment account. Then you would connect your bank account and transfer your cash to the exchange, and finally buy your Bitcoin or any other cryptocurrency you desire that is available to you on the platform.

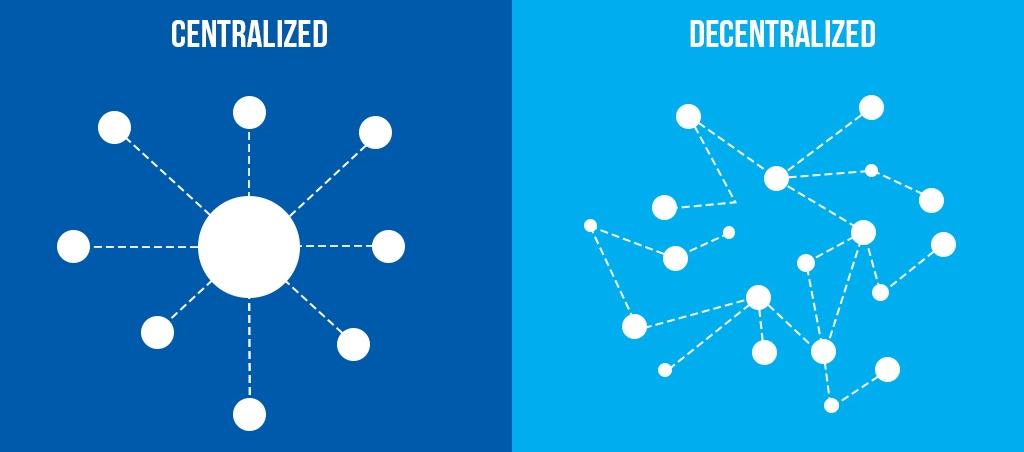

What if the crypto you read about and want to buy isn’t available on Coinbase? What if you hear all the horror stories of exchanges going bankrupt (like FTX, Celsius, Voyager, and more) and people losing their funds, so you want to buy on the CEX and move it to your own wallet? Can you trade it after you move it to your personal wallet? More and more people are moving to trading on Decentralized Exchanges (such as Uniswap and Thorchain, with others getting in the mix) and avoiding Coinbase and Binance after initial purchases. This page will give you a run down on the differences between a Centralized Exchange (CEX) and Decentralized Exchanges (DEX).

Centralized Exchanges (CEX):

In short, a Centralized Exchange acts like a traditional broker, connecting you and your payment methods (bank accounts, PayPal, wires) with an avenue to purchase crypto. They typically do a great job making it easy to do the actual trading, but they are subject to government regulations. This means giving up all of your personal information and now requiring you to provide who you are sending funds to when moving them from an exchange. In other words, the complete opposite of the privacy that crypto can provide. Because they are government regulated, they have the ability to freeze your assets and your account for any reason, and we have first hand knowledge of this with Coinbase.

- Control and Ownership:

- Centralized exchanges are operated by a central authority or company (again, think Coinbase, Gemini, Binance, Kraken). Users entrust their funds to the exchange, and the exchange holds custody of these funds.

- User Verification:

- Centralized exchanges typically require users to complete a registration process that involves identity verification, often in compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Location Limitations:

- Centralized exchanges need government approval to operate in certain places, and so the exchanges are limited in what cryptos you can buy depending on your location. What may be available in Texas might not be available in NY, and what may be available abroad on Binance might not be available anywhere in the USA.

- Trading Speed and Liquidity:

- Centralized exchanges often offer faster transaction speeds and higher liquidity compared to decentralized exchanges. This is because the trading order book is managed centrally, making it easier to match buy and sell orders quickly.

- User Interface and Experience:

- Centralized exchanges usually have more user-friendly interfaces, providing features like advanced trading charts, order types, and customer support.

- Security Responsibility:

- Users trust the centralized exchange with the security of their funds. Security measures are implemented by the exchange, and users have limited control over the security of their assets. As exchanges have gone bankrupt, this has become a major debate topic.

- Regulatory Compliance:

- Centralized exchanges often comply with regulatory requirements, which can provide a sense of legitimacy but may also limit user privacy.

Decentralized Exchanges (DEX):

A decentralized exchange, in comparison, requires zero information about you, doesn’t care who you are or where you work. No need to create an account, give up personal information, get permission from someone, or require trust that the exchange won’t misuse your assets. Simply connect your wallet, and buy/trade what you want to trade. This is what crypto is about.

- Control and Ownership:

- Decentralized exchanges operate on blockchain technology and do not have a central authority. Users retain control and ownership of their private keys and funds.

- User Verification:

- Decentralized exchanges allow users to trade without going through a rigorous identity verification process, providing a higher level of privacy. Just connect your wallet, and trade without needing permission to use it.

- No location limitations:

- Because Decentralized exchanges don’t have a jurisdictional place of business and just operate as code with no central company taking ownership, you don’t need to provide your location to trade and you have access to almost any crypto out there.

- Trading Speed and Liquidity:

- DEXs can have lower liquidity and slower transaction speeds compared to centralized exchanges due to the decentralized nature of order matching and settlement.

- Innovation is rapidly evolving and in some cases, becoming cheaper and easier to use than centralized exchanges. We will visit this more in our Trading crypto pages.

- User Interface and Experience:

- DEX interfaces can vary, and some might be less intuitive for beginners. However, they offer users the benefit of increased privacy and control.

- Security Responsibility:

- Users have more control over the security of their funds in a DEX as they hold their private keys. However, the security of the smart contracts and platform itself is crucial and relies on proper code implementation.

- Regulatory Compliance:

- DEXs may operate in a more decentralized and permissionless manner, which could make them less subject to traditional financial regulations. However, regulatory environments are evolving, and some DEXs may choose to comply with certain regulations, in which case they aren’t truly a DEX.

Summary

In summary, the main distinction between centralized and decentralized exchanges lies in the degree of control, ownership, and privacy provided to users. Centralized exchanges are often more user-friendly with higher liquidity but require users to trust the platform with their funds. Decentralized exchanges prioritize user control and privacy but may have lower liquidity (and thus possibly higher fees) and a steeper learning curve. Decentralized exchanges requires more steps initially to get started, but is crucial to the success of crypto as a whole.