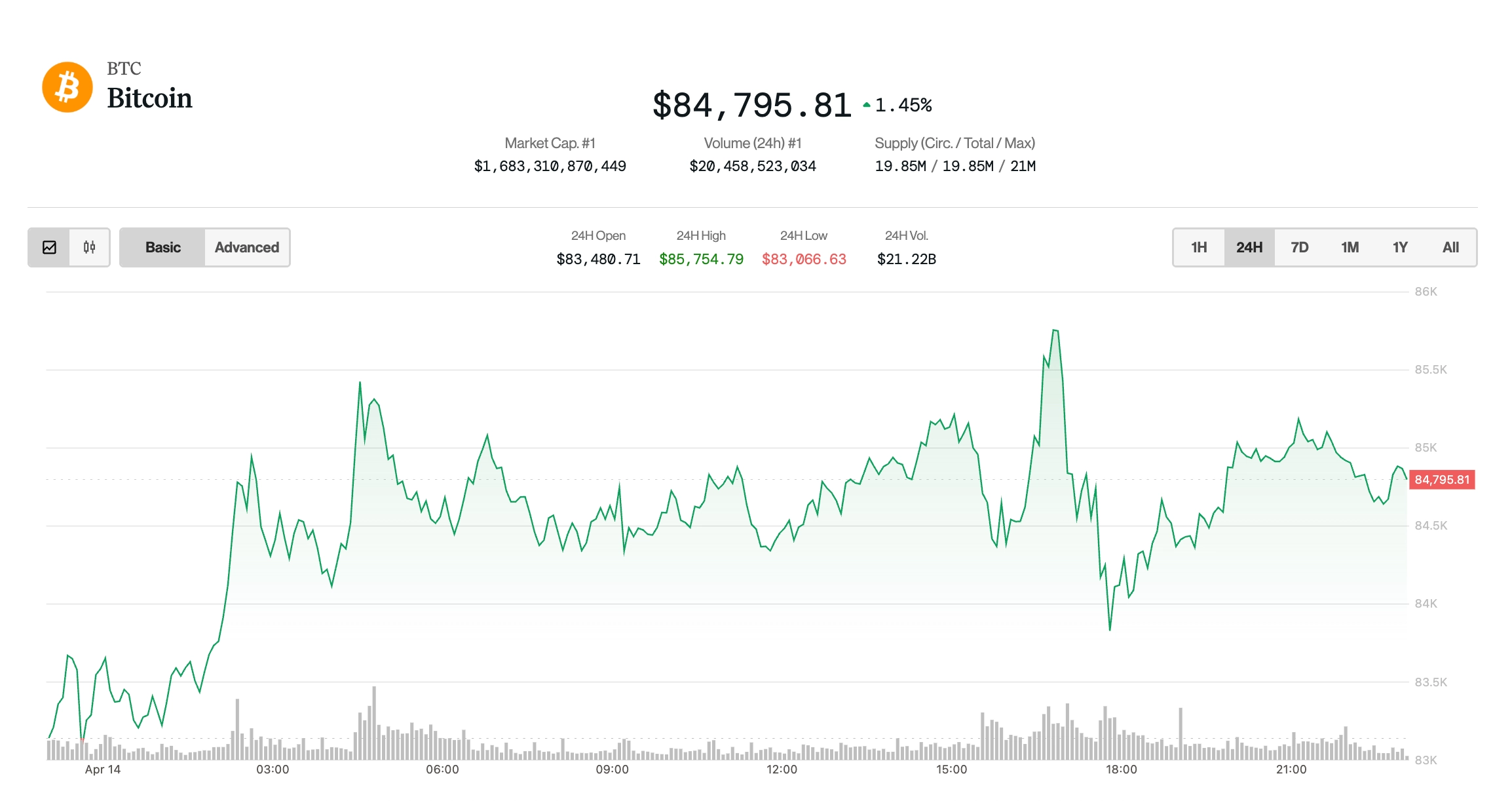

Bitcoin has recently seen a modest rise, trading close to $85,000, amid a more favorable market sentiment and positive developments in trade negotiations.

Federal Reserve Governor Christopher Waller has suggested that a reinstatement of previous tariffs could necessitate significant interest rate cuts. He pointed out that the effects of such tariffs could have lasting impacts on economic output and employment, urging that this should influence monetary policy decisions. The European Commission has also announced a delay in imposing retaliatory tariffs on U.S. goods, citing a need for continued negotiations.

Following these developments, the likelihood of a U.S.-EU trade agreement increased, with prediction markets indicating a 65% chance. Bitcoin’s recent stability is attributed to recovering network fundamentals and stabilizing liquidity, potentially positioning it for future growth.

Swissblock analysts noted that as new investors enter the market, liquidity is stabilizing, leading to less volatility than seen earlier in the year. They highlighted that when liquidity metrics show consistent levels, it typically leads to strengthened price movements. Overall, the combination of improving fundamentals and reduced regulatory concerns has allowed Bitcoin to maintain its position, pushing it just below the critical resistance level of $85,000.

In summary, Bitcoin’s recent performance reflects a mix of positive trade discussions, strategic insights from Federal Reserve officials, and improving market conditions that may indicate a promising upward trend for the cryptocurrency.

________

At Crypto Dummies, we strive to demystify the complexities of the cryptocurrency world for enthusiasts of all levels. Through insightful articles, guides, and analysis, we cover topics ranging from blockchain technology to market trends and investment strategies. Stay informed and empowered with Crypto Dummies – your go-to source for accessible crypto knowledge.