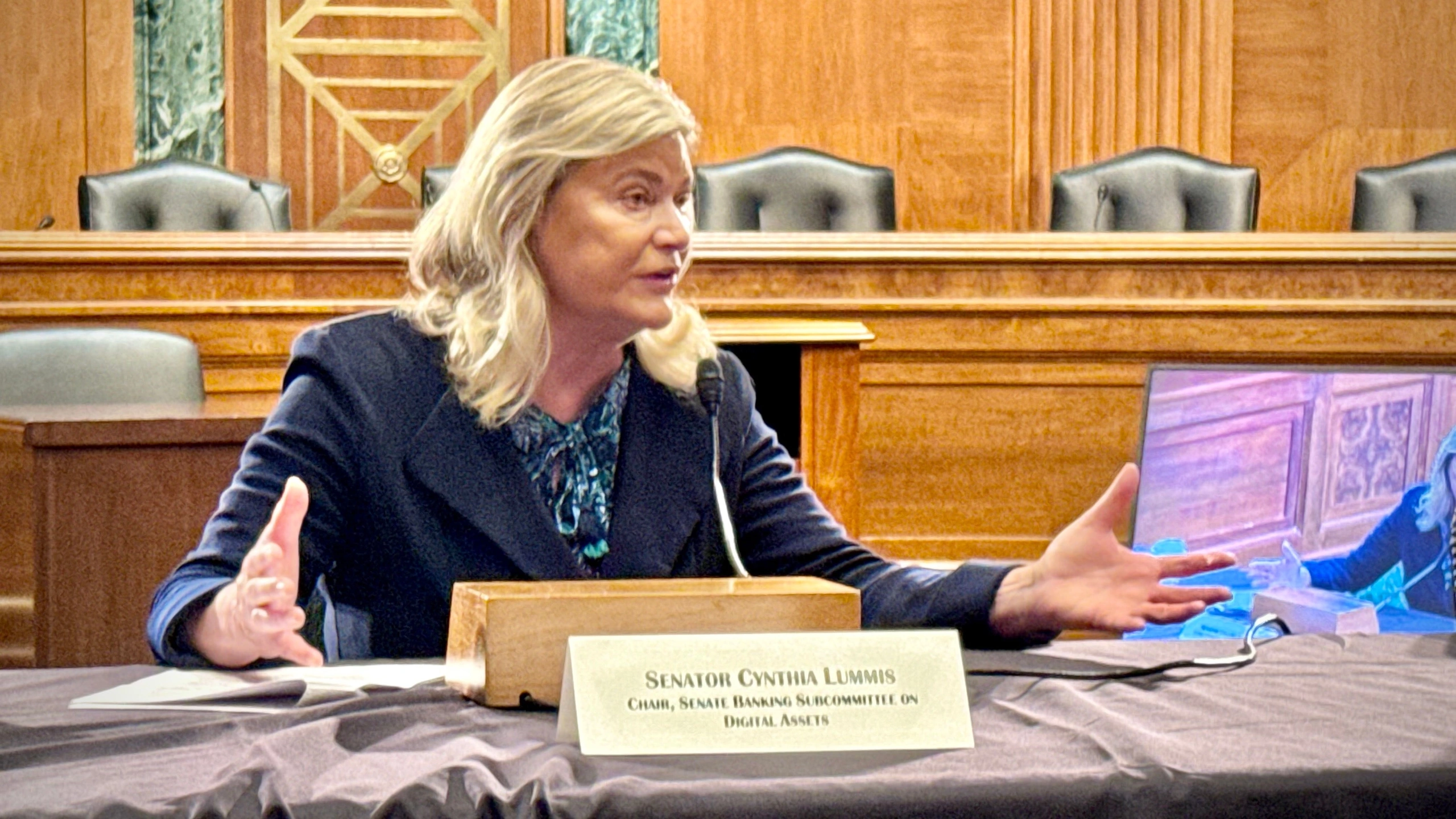

U.S. Senator Cynthia Lummis is working to include a key crypto tax measure in a major budget bill that supports much of President Donald Trump’s agenda. This proposed amendment aims to alleviate the tax implications associated with basic cryptocurrency transactions.

On Monday, Lummis introduced language into Congressional discussions regarding the “Big Beautiful Bill,” seeking to eliminate taxes on small crypto transactions valued at less than $300. The objective is to streamline the current tax system that penalizes users for taxes on both the acquisition and sale of cryptocurrencies involved in activities such as staking and mining.

By allowing small transactions to be tax-free (with an annual limit of $5,000), the amendment would significantly reduce the complexity of calculating capital gains for individuals conducting minimal digital asset transactions. This change is expected to encourage more people to explore the crypto market by removing financial barriers.

The proposed amendment also takes into account tax implications for crypto lending, wash sales, and charitable donations. As highlighted by the Digital Chamber, this adjustment concerning mining and staking would correct a longstanding issue regarding the taxation of rewards received from these activities. Traditionally, individuals have been taxed upon receiving these rewards and again when selling their assets. The amendment proposes to tax rewards only at the time of sale, aligning tax policy with actual income.

Rewards from staking in blockchain networks, for instance, are currently taxed when received and again upon sale. The Lummis amendment aims to change this, ensuring that all assets obtained through actions like airdrops or forks would only be taxed upon sale.

Additionally, the amendment seeks to address the issue of wash trading, a loophole where investors engage in tax-loss harvesting by selling assets at a loss and immediately repurchasing them.

As Congress navigates this “vote-a-rama” amendment process, the stakes are high. While Senate Republicans are striving to secure votes for the bill, they face opposition from Democrats who have concerns over aspects such as potential Medicaid cuts and green energy initiatives embedded in the extensive legislation. The House of Representatives narrowly passed its version of the spending bill last month and would have to approve it again if the Senate incorporates changes. Analysts predict the proposal could exacerbate the U.S. budget deficit by over $3 trillion.

________

At Crypto Dummies, we strive to demystify the complexities of the cryptocurrency world for enthusiasts of all levels. Through insightful articles, guides, and analysis, we cover topics ranging from blockchain technology to market trends and investment strategies. Stay informed and empowered with Crypto Dummies – your go-to source for accessible crypto knowledge.