What are they?

Let’s say you just bought PEPE but now you think something else will go up in price, such as SHRAP and want to trade for it. It is just a simple and easy swap, right? PEPE is on ETH, and SHRAP is on Avalanche chain, so unfortunately it may not be that easy. This is where a DEX aggregator can come in to play.

As you will notice in our Decentralized Exchange article, many blockchains have their own DEX or multiple DEX’s. Uniswap for Ethereum, Jupiter for Solana, Trade Joe for Avalanche, PancakeSwap for Binance Smart Chain, etc. However, cross-chain DEX are on the rise and so are DEX aggregators. A DEX aggregator is a service that connects many different Decentralized Exchanges to allow you to 1. receive best pricing among the many different DEX’s, and 2. if the aggregator allows for it, also allow you to easily swap cross-chain, such as an ETH coin for an Avalanche coin, for example. These aggregators allow you to pick which route to go, for example you can pick between THORChain or Chainflip depending on which one gives you the best pricing.

You will see a lot of THORChain mentioned here because it is currently the best way to swap cross-chain without the need for a bridge, i.e. Bitcoin to Ethereum to Litecoin to Dogecoin–you get the idea. THORChain doesn’t support all assets, but the developers are always hard at work to add the big blockchains if not currently supported, such as Solana (at the time of this writing, THORChain has acknowledged Solana is in the works).

How does it work?

When a user initiates a swap, the aggregator does the behind the scenes work to pull information from different exchanges and determine which one currently has the best pricing available. If you are going from one chain to another, such as an ETH coin to an Avalanche coin, the DEX does the behind the scenes work to bridge assets from one chain to another, before finally swapping for the asset you want. Of course, bridging can be done manually if you know how to bridge assets and want to take the time to do so, but an aggregator will do that work for you from one location/interface.

Each transaction from chain to chain incurs transaction costs each time, so protocols like THORChain that offer direct swaps from one chain to another that are both safer and cheaper.

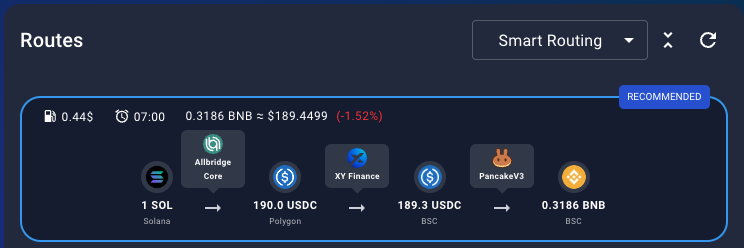

For example, here is the routing from Rango Exchange to swap SOL (Solana) for BNB (Binance Smart Chain):

From Solana to USDC on Polygon using Allbridge Core, then to USDC on BSC through XY Finance, then finally to BNB through Pancake Swap. This is what makes cross-chain aggregators valuable by handling this for you from one interface.

Aggregator options

This is not an exhaustive list, but some of the more popular names plus a few up and comers:

Cross-chain aggregators:

- Rango Exchange- handles 50 different blockchains by utilizing more than 60 different DEXs and 25 bridges, including all of the major blockchains. Integrates THORChain for Bitcoin swaps. Charges .15% for swaps.

- THORSwap- supports 10 blockchains, and aggregates pricing from many DEXs and aggregators. Integrates THORChain and Chainflip for Bitcoin swaps. Charges .3% for swaps above $100.

- Defispot- Integrates THORChain for Bitcoin swaps. Charges .1% for swaps.

- ShapeShift- Integrates THORChain for Bitcoin swaps, Savers, and Lending. Charges .3% for swaps.

- THORWallet- Integrates THORChain, Maya, and Chainflip for Bitcoin and cross-chain swaps. Charges 1% for swaps.

- El Dorado- Integrates Maya Protocol and Chainflip for cross-chain swaps, with Rango and THORChain coming in the future. Charges .7% for swaps.

Single chain aggregators:

- 1inch- an Ethereum DEX aggregator. Not available in the USA, but using other aggregators such as THORSwap, which accesses 1inch, is one way around that.

- Jupiter- a Solana DEX aggregator. Jupiter can tap into the liquidity on both Raydium and Orca to get you best pricing within the Solana network.

THORChain (cross-chain, direct multi-asset swaps)

We talked THORChain in its own DEX article, however it essentially acts as its own aggregator because it offers cross-chain swaps of many different assets on its own. THORChain is also integrated into many of the aggregators listed above due to it being the best and biggest Bitcoin DEX there is.

However, THORChain offers native assets directly for other native assets, so no need to bridge or buy different cryptos to get your desired crypto. By going directly from one native asset to another, you save on fees and is far more secure.

Maya Protocol (cross-chain, direct multi-asset swaps)

Maya Protocol is a THORChain fork and is working on expanding to blockchains that are not supported on THORChain. While there are a few differences between Maya and THORChain, Maya at its core offers similar functionality–cross-chain, permissionless swaps without the need for bridges.